When it comes to streaming entertainment, Netflix has remained a household name across the globe. From its humble beginnings as a DVD rental service to becoming a leader in digital streaming, the company has transformed how we consume movies and TV shows. But beyond its entertainment value, Netflix stock has become a hot topic for investors who see it as a gateway into the growing world of online streaming and digital media.

A Brief History of Netflix Stock

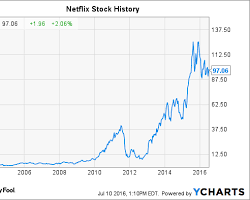

Netflix went public in 2002 at just $15 in step with percentage. At that time, very few predicted it would become a global leader in entertainment. Over the years, the stock price skyrocketed as Netflix shifted from physical DVDs to an online streaming platform, and later to producing its own original content like Stranger Things and The Crown. Investors who held onto their early shares witnessed massive gains, cementing Netflix as one of the biggest success stories in the stock market.

Current Performance of Netflix Stock

In 2025, Netflix stock remains one of the most closely watched equities in the media and technology sector. The company consistently reports millions of new subscribers each quarter, thanks to its aggressive expansion into global markets and continued investment in original films and series.

However, Netflix also faces stiff competition from Disney+, Amazon Prime Video, Apple TV+, and other platforms. This rivalry affects its stock price movements, creating both challenges and opportunities for investors.

Why Investors Are Interested in Netflix Stock

- Global Reach: Netflix operates in over 190 countries, with a subscriber base exceeding 250 million.

- Strong Brand: Its name is synonymous with streaming, giving it a competitive advantage.

- Content Powerhouse: With billions invested in original shows and films, Netflix continues to dominate cultural trends.

- Revenue Growth: Subscription-based models offer consistent revenue, even during market fluctuations.

- Potential in Gaming & Interactive Media: Netflix is expanding into gaming, which could boost long-term growth.

Risks of Investing in Netflix Stock

While Netflix stock offers many benefits, investors should also be cautious of potential risks:

- Rising Competition: Other platforms are catching up quickly with exclusive content.

- Content Costs: Original shows and films require massive budgets, impacting profitability.

- Subscriber Saturation: In mature markets like the U.S., subscriber growth has slowed.

- Debt Levels: Netflix often relies on debt to finance new projects, which could affect future stability.

- Market Volatility: Like any tech stock, Netflix can experience sudden price swings.

- click here for slugify tool

Factors Influencing Netflix Stock Price

- Subscriber Growth: The biggest driver of stock performance.

- Content Success: Hit shows often boost share prices, while failures can drag them down.

- Partnerships & Acquisitions: Deals in gaming, technology, or international expansion matter.

- Earnings Reports: Quarterly financial results heavily influence investor confidence.

- Global Economy: Currency fluctuations and inflation affect overall performance

Tips for Investing in Netflix Stock

- Diversify: Don’t put all your money into Netflix—balance with other tech or media stocks.

- Watch Earnings Reports: Keep an eye on subscriber numbers and profitability.

- Long-Term Perspective: Netflix is better suited for long-term investors who believe in the future of streaming.

- Stay Updated: Monitor competition and industry trends to understand future risks.

Conclusion

Netflix stock remains one of the most exciting opportunities in the streaming industry. Its global reach, innovative content strategy, and ability to shape entertainment culture give it a powerful edge. However, investors must balance this potential with risks such as rising competition, debt, and subscriber saturation. For those willing to take a long-term approach, Netflix stock can still be a strong addition to a diversified portfolio in 2025 and beyond.

FAQs

Why is Netflix stock rising?

Strong subscriber growth, hit content, and global expansion drive Netflix stock upward.

How many Netflix stocks are there?

Netflix has around 440 million outstanding shares traded on the NASDAQ.

Is Netflix a good stock to buy?

Yes, for long-term investors, though risks like competition and debt should be considered.

Who has the most stock in Netflix?

Vanguard and BlackRock are among the largest institutional holders of Netflix shares.

Related Queries

Why is Netflix stock rising, Why did Netflix stock fall, Netflix stock performance over the years, Is Netflix stock overvalued or undervalued, Factors affecting Netflix stock price, Will Netflix stock grow in the future, Should I invest in Netflix stock long-term, How does competition affect Netflix stock