The stock market never truly sleeps. While the trading floor of the New York Stock Exchange closes in the afternoon, financial markets around the globe continue to move. One of the tools that allow investors to monitor and react to these shifts is Dow Futures. For traders, analysts, and even casual investors, Dow Futures provide valuable insight into how the market may open and perform.

What Are Dow Futures?

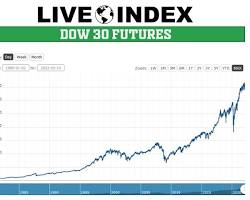

Dow Futures are financial contracts linked to the Dow Jones Industrial Average (DJIA), one of the world’s most widely followed stock market indexes. These contracts give investors a way to speculate on or hedge against the future performance of the index.

The Dow Jones itself tracks 30 large, publicly traded U.S. companies across industries such as finance, healthcare, technology, and manufacturing. Futures tied to this index let traders buy or sell contracts that represent the expected movement of the Dow in the future.

How Dow Futures Work

Like all futures contracts, Dow Futures are agreements to buy or sell the underlying index at a set price on a future date. While most retail investors do not hold these contracts to expiration, they trade them for short-term speculation.

For example, if an investor believes the market will rise, they may go “long” on Dow Futures. If they think it will fall, they can go “short.” The ability to trade in either direction makes futures attractive, especially during times of uncertainty.

Dow Futures also trade outside of regular stock market hours, giving investors a glimpse into how the market might open the next day. This is why news outlets often report overnight movements in Dow Futures as an early signal of market sentiment.

Why Are Dow Futures Important?

- Market Sentiment Indicator: Futures often reflect how investors react to breaking news—economic reports, earnings releases, or global events—before the regular market opens.

- Risk Management: Portfolio managers use Dow Futures to hedge against potential losses. For instance, if they hold a large stock position, they can short Dow Futures to protect against a downturn.

- Global Connectivity: Because financial markets are interconnected, Dow Futures give international traders a chance to participate in U.S. markets around the clock.

Factors That Influence Dow Futures

Several factors impact the movement of Dow Futures:

- Economic Data: Reports like job numbers, inflation rates, and consumer spending can move futures quickly.

- Federal Reserve Policy: Interest rate changes and monetary policy statements directly affect market expectations.

- Corporate Earnings: Results from companies in the Dow can shift futures dramatically.

- Global Events: Geopolitical tensions, wars, or pandemics often cause sudden futures volatility.

- Commodity Prices: Oil and gold prices sometimes influence investor sentiment reflected in Dow Futures.

Trading Dow Futures

Trading Dow Futures requires an account with a broker that offers access to futures markets. They are typically traded on the Chicago Mercantile Exchange (CME). Investors can trade standard contracts or smaller versions known as E-mini Dow Futures, which are popular among retail traders due to their lower capital requirements.

However, futures trading is not without risks. Leverage—using borrowed money to amplify trades—can magnify both gains and losses. This makes Dow Futures more suitable for experienced traders who understand volatility and risk management.

Benefits and Risks

Benefits:

- Provide exposure to U.S. markets even outside trading hours.

- Useful for hedging portfolios against volatility.

- Allow speculation on market direction with relatively small capital.

Risks:

- High volatility can cause rapid losses.

- Leverage increases risk exposure.

- Requires knowledge of futures markets and active monitoring.

Dow Futures vs. Stock Investing

While investing in individual stocks involves buying ownership in companies, Dow Futures are purely derivative contracts. They don’t provide dividends or direct ownership, but they do offer flexibility and 24-hour trading opportunities. Many investors use them in combination with stocks to balance their strategies.

Conclusion

Dow Futures play a crucial role in global finance by offering insights into investor sentiment, risk management tools, and speculative opportunities. While they are not for everyone—given their complexity and risks—they remain a key instrument for traders and institutions alike. Understanding Dow Futures can help investors interpret market signals and make better-informed decisions, especially in a fast-moving financial world.

FAQs

What are Dow Futures?

Dow Futures are contracts that let investors speculate on the future value of the Dow Jones Industrial Average.

Why do investors watch Dow Futures?

They provide early insight into market sentiment and predict how the stock market might open.

When can you trade Dow Futures?

Dow Futures trade nearly 24 hours a day on the Chicago Mercantile Exchange (CME).

How risky are Dow Futures?

They can be highly risky due to leverage and volatility, but also offer big opportunities.

What moves Dow Futures prices?

Economic data, Federal Reserve policy, global news, and corporate earnings impact prices.

Can beginners trade Dow Futures?

Yes, but it requires knowledge, risk management, and often works best through E-mini contracts.

How are Dow Futures different from stocks?

Stocks give ownership in a company, while Dow Futures are derivatives tracking an index.

Related Queries

- What are Dow Futures and how do they work?

- How do Dow Futures affect the stock market?

- Why do Dow Futures trade overnight?

- Are Dow Futures a reliable market indicator?

- How can beginners trade Dow Futures?

- What moves Dow Futures prices?

- Dow Futures vs. S&P Futures: what’s the difference?

- Where are Dow Futures traded?

- Are Dow Futures risky for investors?

- How do global events impact Dow Futures?